Financial Planning

I offer two paths for financial planning – personal and business. Both are available via an ongoing engagement or on a project-basis with pricing based on complexity.

Ongoing Personal Financial Planning

Ongoing Personal Financial Planning is designed to partner with you on your financial journey. The foundation of my process is to start by listening to, understanding and building upon your priorities, goals and values.

From there, I’ll analyze your finances in order to recommend an actionable plan that will cover all the relevant areas such as cash flow, budgeting, debt management, tax planning, investing, insurance, retirement, estate planning, real estate and more.

Then, I’ll work with you to implement the plan and follow up on an ongoing basis to monitor and review and ensure we are continually considering how your life, family, tax situation and priorities are changing.

Ongoing Business Financial Planning

Ongoing Business Financial Planning is designed to align your personal financial goals with the financial health and strategic direction of your business – with ongoing deliverables such as detailed cash flow modeling, operational strategy or ongoing advisory related to business decision-making. These services are modular to focus on one or more key areas of your choice such as:

- Asset Protection

- Cash Flow Analysis

- Continuity, Succession or Exit Planning

- Coordination with Accounting, Tax or Legal Professionals

- Debt Analysis

- Entity Structure Review

- Financial Goals

- Insurance Planning

- Liquidity Analysis

- Making Investments in the Business

- Owner Compensation Strategies

- Real Estate Analysis

- Retirement Planning

- Risk Management

- Tax Planning

- Tracking Key Performance Indicators (KPIs)

A full description of each topic can be found in our ADV Part 2A.

Project Based Financial Planning

I am also available to work on an hourly or project basis to provide one-time solutions for selected personal or business financial planning topics.

Investment Management

I’ll build and manage an investment portfolio tailored to your goals, investment objectives, time-horizon and risk tolerance. As a fee-only advisor, I don’t collect commissions on funds or financial products so I won’t recommend anything you don’t need.

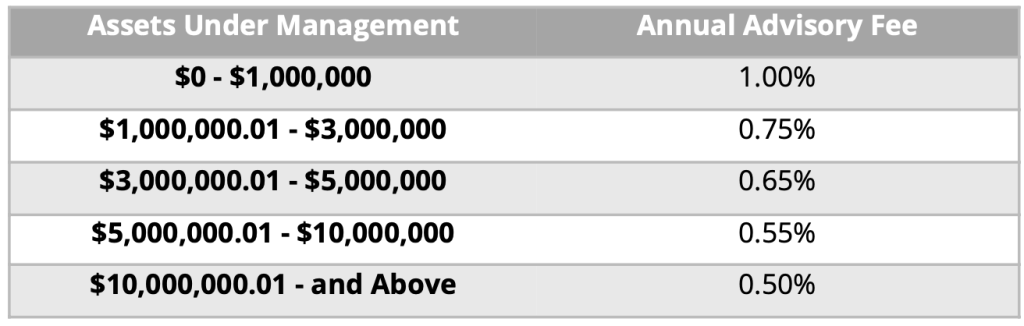

My annual fee starts at 1.0% for the first $1 million under management and decreases for a blended rate as investment capital grows per the schedule below. The minimum account size requirement is $250,000 which may be reduced or waived on a case-by-case basis. After the first year, investment management clients with at least the minimum account size in managed assets receive ongoing personal financial planning support and updates to their plan at no additional cost.

Free Consultation

If you believe you could benefit from working with a financial advisor, let’s start the conversation and find out. Please follow the link below to book a free consultation. We’ll discuss your needs and what I do. These meetings are held by phone or video call. After that, meetings are held by phone, video call or in-person.